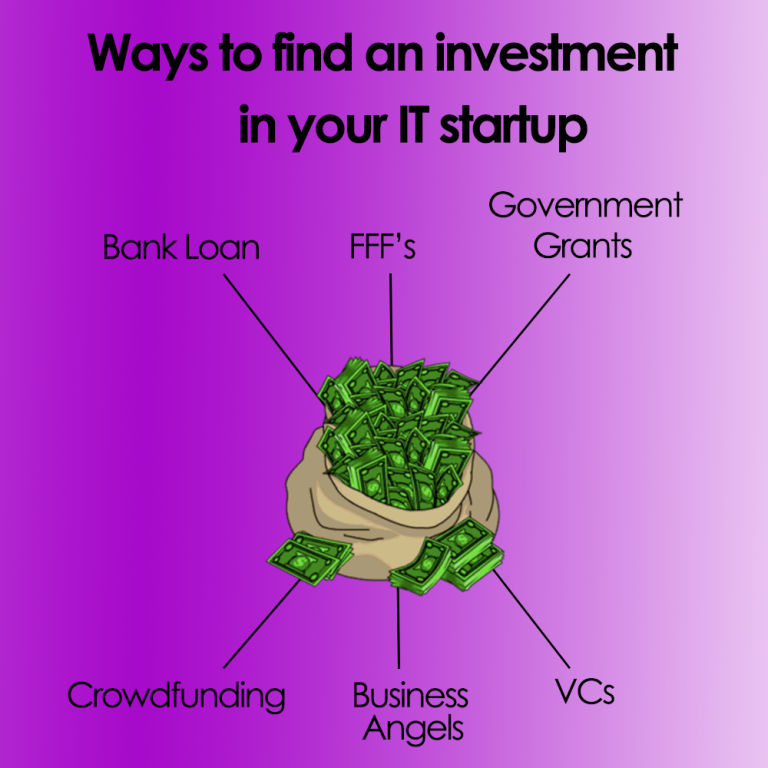

Money is the blood of any business, and investment is one of the ways to get the necessary funds that can be used to modernize, improve or scale up a business. Today we present you 6 ways to find an investment in your IT business. Use our experience to grow your business. 💥🚀

How to find investments to IT Startup

We have collected the most popular and effective ways to attract investments in a startup. Perhaps not each of the points below will suit you, but among them, you will definitely find 2-3 ideas that will help you find the money.

1. Bank Loan

Bank loans are not the most popular way to attract money to a business, but this is also an option. If you competently present your startup to a bank manager, then you will surely get money from him. But clarify all the risks, complex bank charges, and percents before taking a loan. Investing your own money is one thing but taking a bank loan to do so is a totally different game.

Pros

- Large capital can be accessed by entrepreneurs.

- Provided capital can fast-track the process of income generation.

Cons

- High risk of Collateral loss, since it is an important requirement for loan grants.

2. Friends, Family, Fools (FFF’s)

Friends and family are the most commonly used funding sources by startup founders for many reasons because these people near you. Also in the life of every person, there are people with a lot of money, that they may invest in any startup to make profits in the future. Make a list of so-called FFF’s, and then share your idea with them.

Pros

- This is a very easy way to find investments.

Cons

- Because of such cooperation, you can falling-out with friends or relatives for the rest of your life.

- The size of the investment is often not high.

3. Government Grants

A grant is one of the ways the government funds ideas and projects to provide public services and stimulate the economy. Grants support critical recovery initiatives, innovative research, and many other programs listed in the Catalog of Federal Domestic Assistance (CFDA). The federal government typically awards grants to state and local governments, universities, researchers, law enforcement, organizations, and institutions planning major projects that will benefit specific parts of the population or the community as a whole.

Pros

- Funding from the government is usually substantial in size, thus providing you with surplus capital to manage your startup

Cons

- The process of scrutiny, approval and eventual release of funds may take a lot of time due to government bureaucracy

4. Crowdfunding

Crowdfunding is an incredibly powerful source of funding if successful. These platforms are basically set up for individuals to pitch their business ideas or challenges to a community of investors or people willing to support their ideas or cause. But we advise crowdfunding when you have a product that has proven its market suitability, and you need additional capital to start production.

How it basically works is that a person creates his project on a crowdfunding platform, where he describes the product, business model, and shares its growth potential. If the idea is interesting to crowdfunders on the platform, they’ll make a pledge to support his business model publicly and donate funds respectively.

The Most popular platforms – Kickstarter & Indiegogo.

Pros

- Crowdfunding platforms can attract not only investors but also potential customers to your business. Experienced entrepreneurs use Crowdfunding as a marketing tool.

- Crowdfunding eliminates the intricacies involved in placing your business in the hands of an investor or a broker and wields that power to simpletons on the crowdfunding platform.

- Has the potential to attract venture-capital investment as the business progresses.

Cons

- If your business pitch isn’t as solid as your competition, then there is a probability that your business idea will be overlooked or rejected

5. Business Angels

Angel investors are high wealth individuals who, more often than not, are entrepreneurs themselves. Having a good Angel on board is your guide to success.

Pros

- Angel investors offer mentorship alongside capital for startups.

- Angel investors are willing to take risks on business idea as they anticipate a heavy return on investment from your startup.

Cons

- With the investment, you get the partner who has own possibly terrible character and maybe you will have different views on business development. Are you ready for this?

- Angel investors provide lower investment capital to business ideas compared to venture capitalists.

6. Venture Capitals (VCs)

VCs are a very important part of the startup ecosystem but it is really important to understand when the right time to partner up with a VC. Because the funds are managed by experienced professionals that have a keen eye for seeking out companies with great prospects.

There are many great companies that are engaged in startups at different stages, such as Accel Partners, Kleiner Perkins & Greylock Partners, and many others.

Pros

- The mentorship and expertise venture capitals will be literally like adding rocket fuel to your startup.

- Venture Capitals effectively monitor the progress of a company they have invested in, thus ensuring the sustainability and growth of their investment.

Cons

- You tend to lose control of your business since you’re giving up a large part of it to venture capital investors.

Conclusion

The tactics in this guide can greatly increase the chance of survival and growth of your startup. However, in order to truly remain competitive in the market, you must always change sources of financing. This provides a certain level of flexibility and over-reliance on a single source of funding.

Do you read our last article “90% Of Startups Fail: Top 5 reasons for IT startup failure”?

If you need to get IT consulting just write us on office@syntech.software.

Let's collaborate!

Share the details of your project – like scope, timeframes, or business challenges you'd like to solve. Our team will carefully study them and then we’ll figure out the next move together.